Recently, Ken Ofori Atta, the minister of finance, expressed surprise at the ongoing picketing of Pensioner Bond Holders at his office. He claims that since the ministry had addressed the pensioners’ complaints, there was no longer a need for daily picketing.

In a release, the ministry indicated that participating in the debt restructuring was voluntary therefore pensioners could decide whether to participate or not. However, the aggrieved pensioners insist that Minister must make it formal and include that their bonds are exempted from the debt restructuring.

The Finance Minister suggested the demands had already been met.

“I issued a press release some time ago and I had made it equivocally clear that all government bonds will be honoured and that therefore whether you are voluntary or not, whether you have tendered or not it will be respected. I really want to understand why you are still here so that if there is anything more, I can say I can do that,” he said.

Addressing the pensioners picketing at the Finance Ministry on Wednesday, he said although the release had indicated that tendering of bonds was voluntary, many pensioners did not tender their bonds.

The Minister reassured pensioners that the government was committed to honouring their bonds whether they tendered or not.

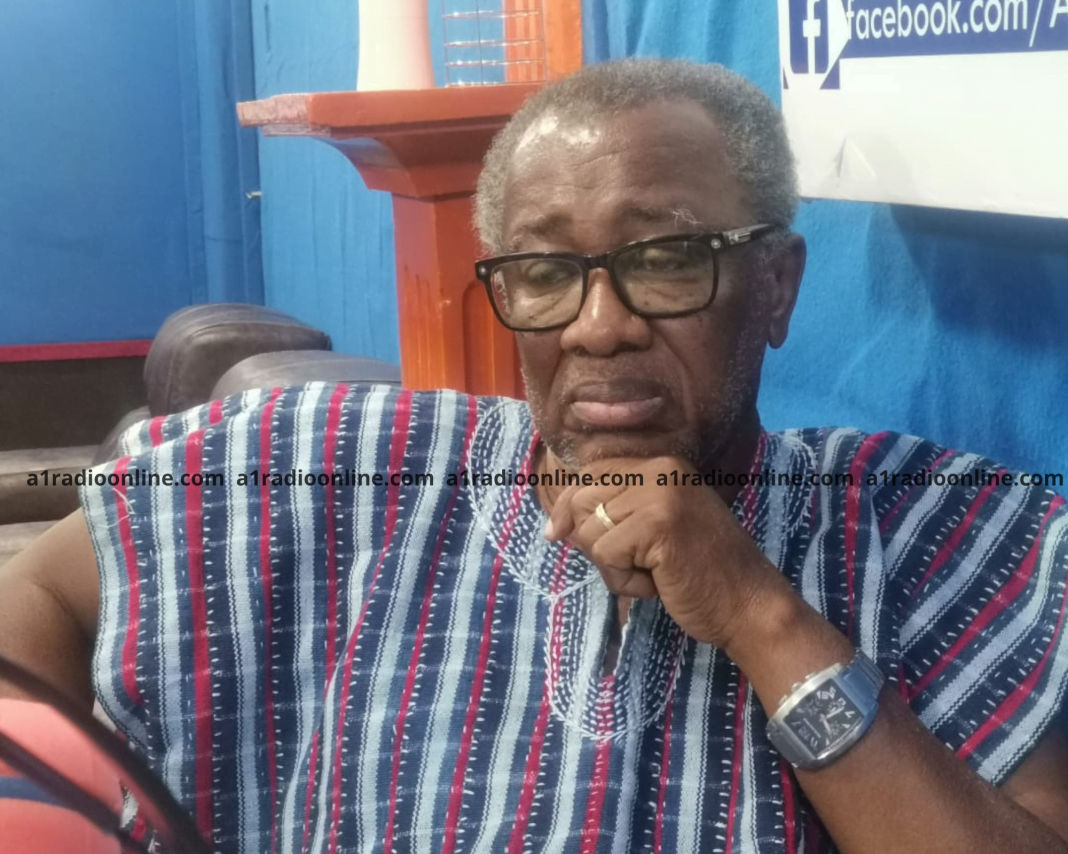

The Finance Minister’s understanding of the issue is however being called into question. When Professor David Millar, an individual bondholder and the President of the Millar Open University spoke on the Day Break Upper East Show, he suggested that the Minister may have lost his ability to understand the English language.

“For me, all of a sudden, the Finance Minister has lost his power over the English language. He has suddenly become illiterate, he can’t read English anymore. It is a simple thing [he has to say]; I exempt you from this debt restructuring,” he said.

According to Professor David Millar, the Finance Minister’s insistence on voluntary exemption by the Finance Minister is worrying.

In an earlier interview, the founder of the Millar Open University and individual bond holder, Professor David Millar, is worried that the President, Nana Akufo-Addo, and his Finance Minister, Ken Ofori Atta, are not grasping the actual consequence of their insistence on individual bond holders in the ongoing Domestic Debt Exchange (DDE).

As part of the government’s effort to secure board level agreement for an IMF programme, it launched the Domestic Debt Exchange programme in December last year. The programme was to help the government restructure its debt and prove debt sustainability. The government included individual bond holders in its attempts to satisfy the pre-conditions for an IMF deal.

The decision was met with stiff opposition by the individual bond holders.

When Professor Millar spoke at a round table discussion on A1 Radio’s Day Break Upper East Show, he expressed worry about losing the value of his investments.

“I am a bond holder; quite a substantial amount. We were made to understand that it was the most secure way of keeping your money. The government bonds served as a very secure place to put your money. [I want to start] with the borrowing spree we went on. For me, borrowing is not the problem. The problem is what you use the borrowed funds to do. You can borrow excessively and invest in such a way that you pay plus profits. This is what we missed. That is where the government failed.”

Source: A1radioonline.com|101.1MHz|Mark Kwasi Ahumah Smith|Ghana